Ho Chi Minh City, Vietnam – July 10, 2025 – Vietnam’s economy achieved a remarkable 7.52% growth in the first half of 2025, driven largely by robust performances in its services and manufacturing sectors. This impressive expansion comes despite persistent global trade tensions and the introduction of new US tariffs. This article offers an in-depth analysis of Vietnam’s economic trends, including inflation, trade, foreign direct investment (FDI), and business formation during this period.

Record-Breaking GDP Growth in H1 2025

Building on the strong momentum of 2024, which saw a GDP growth of 7.09%, Vietnam’s economy surged by 7.52% in the first six months of 2025. This marks the fastest first-half pace in 15 years, a significant achievement given the global challenges of high interest rates, subdued consumer demand, and ongoing trade disruptions. Vietnam continues to solidify its position as one of Southeast Asia’s fastest-growing economies while maintaining macroeconomic stability.

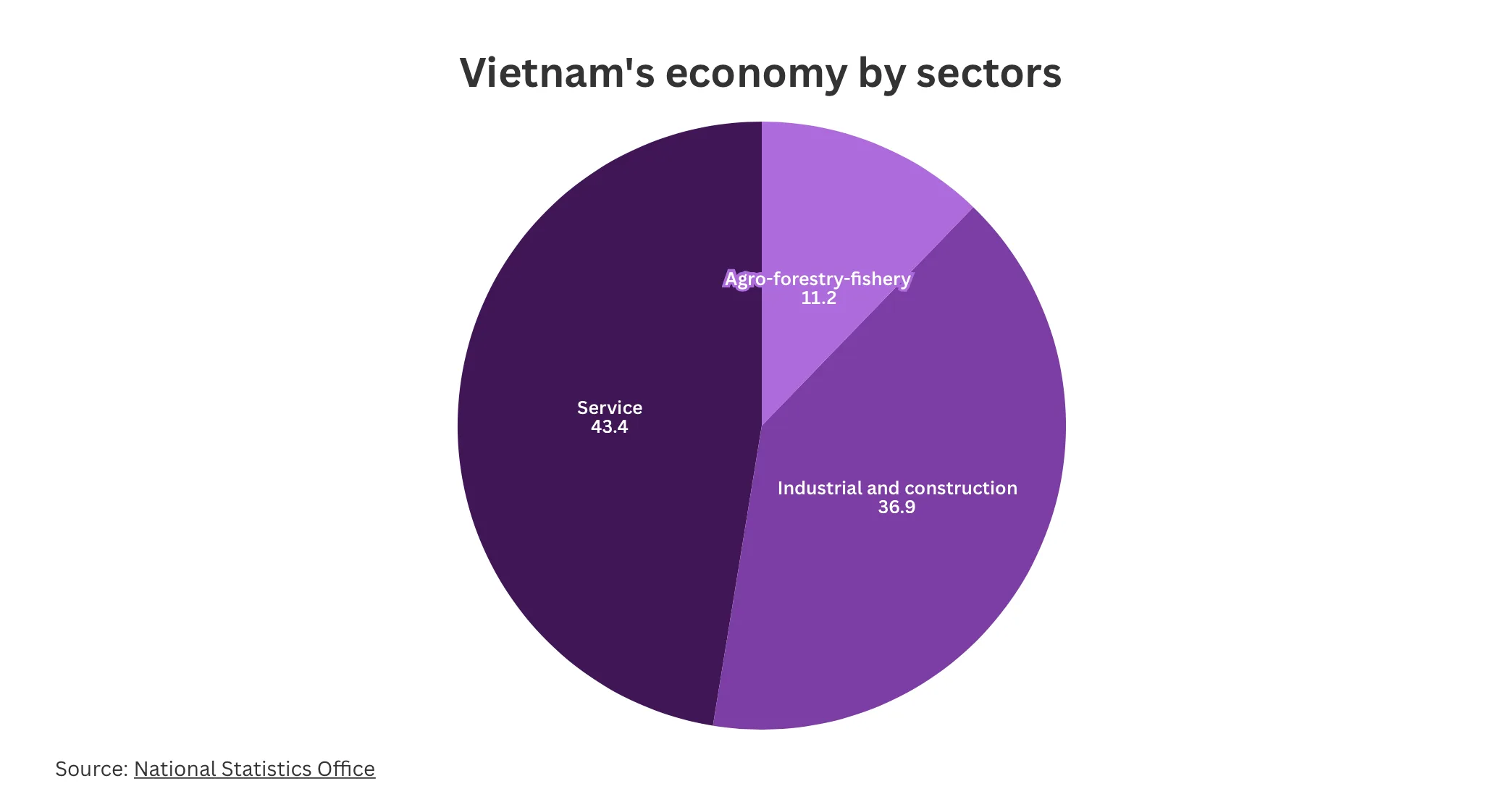

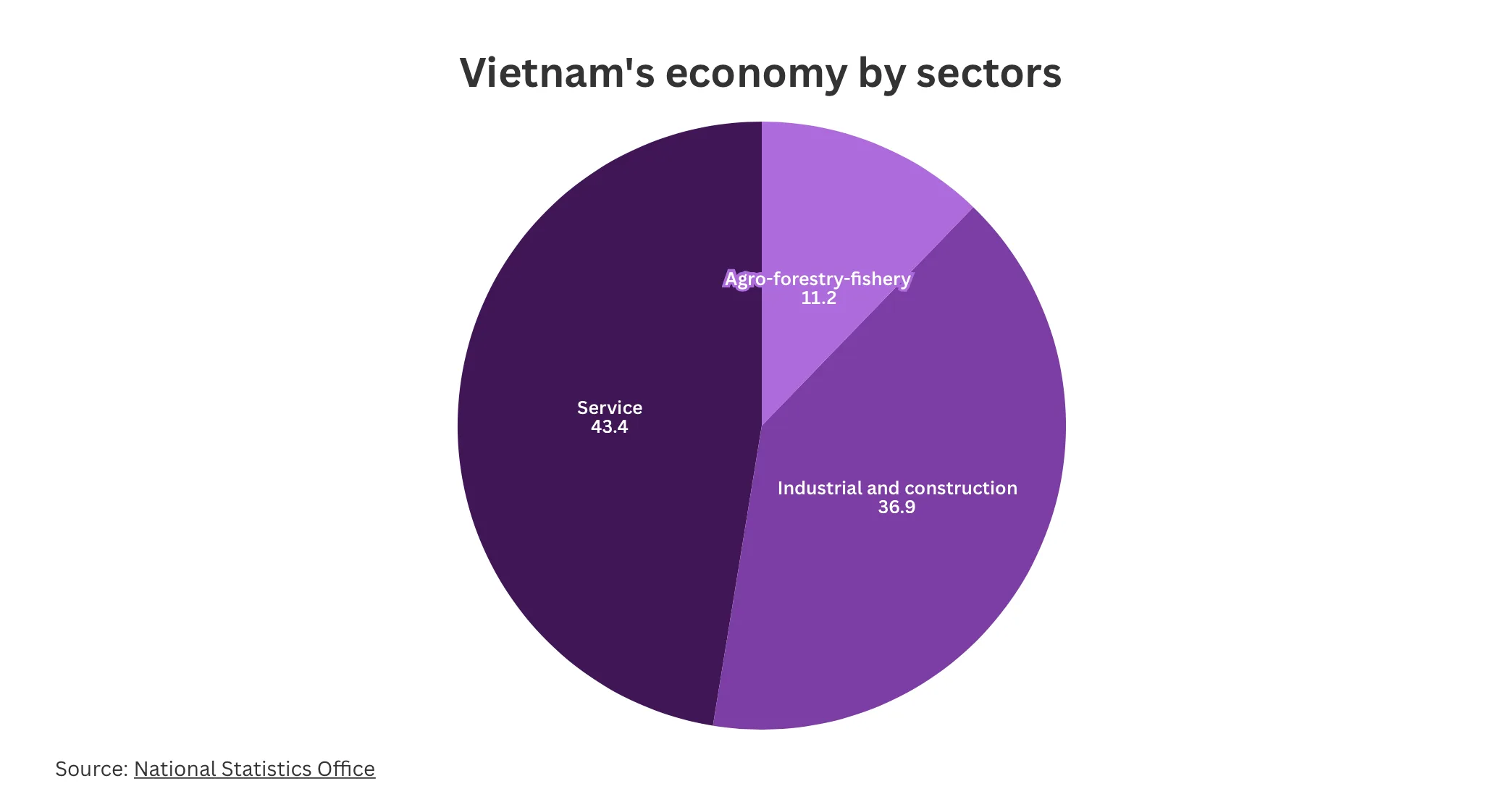

Key sectors contributing to this impressive growth include:

- Agriculture, forestry, and fisheries expanded by 3.84%, providing a stable foundation amidst domestic and export demand.

- Industrial production and construction collectively grew by 8.33%.

- Services saw a significant rebound, growing by 8.14%—the highest first-half growth for the sector since 2020.

The services sector now accounts for 43.4% of GDP, with industrial production and construction at 36.9%, and agriculture and fisheries making up 11.2%. Taxes represent the remaining 8.3%. Services were also the largest contributor to GDP growth, adding over half of the total increase, followed by industrial and construction activities, and agriculture.

Image: vietnam-briefing

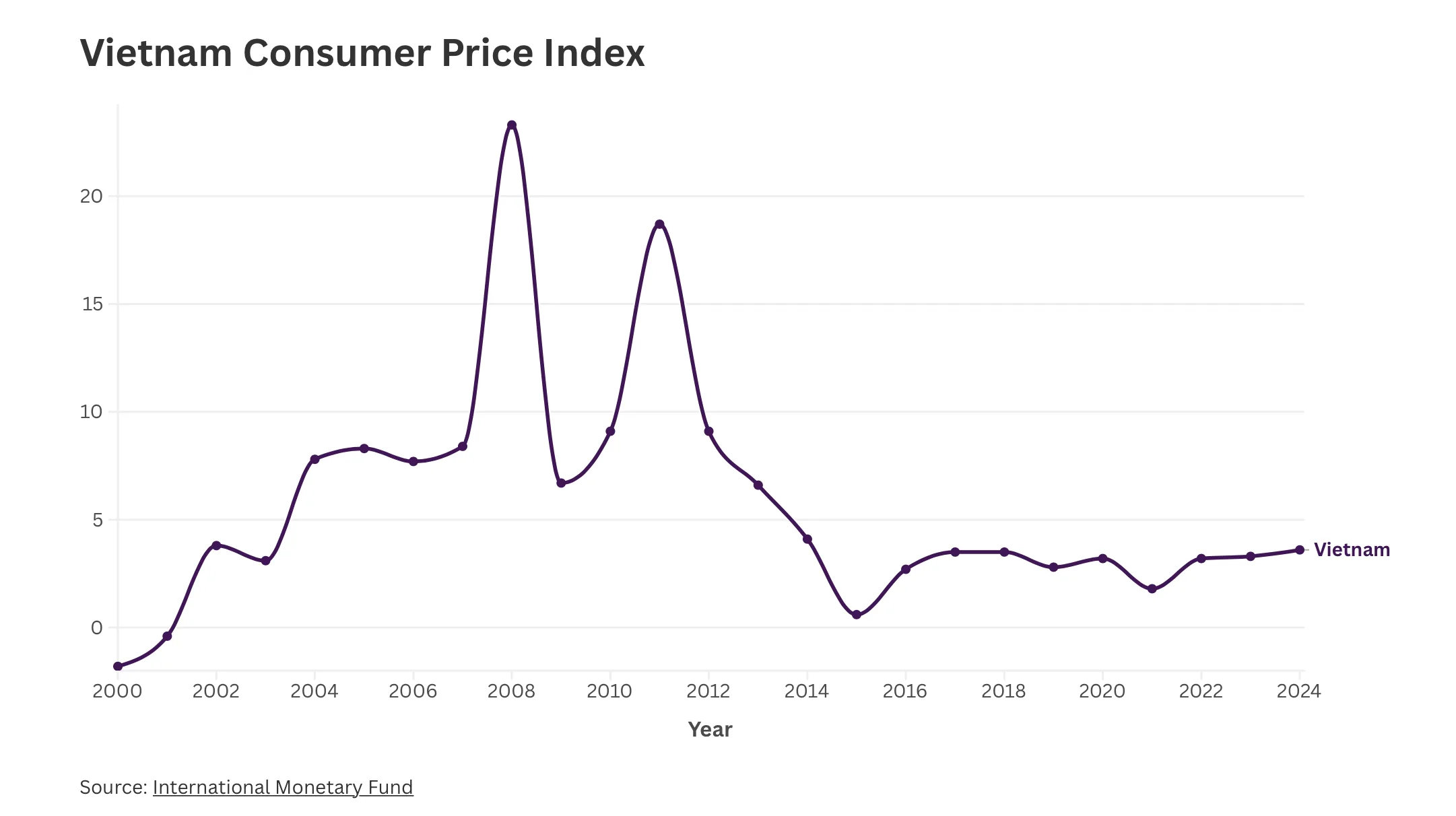

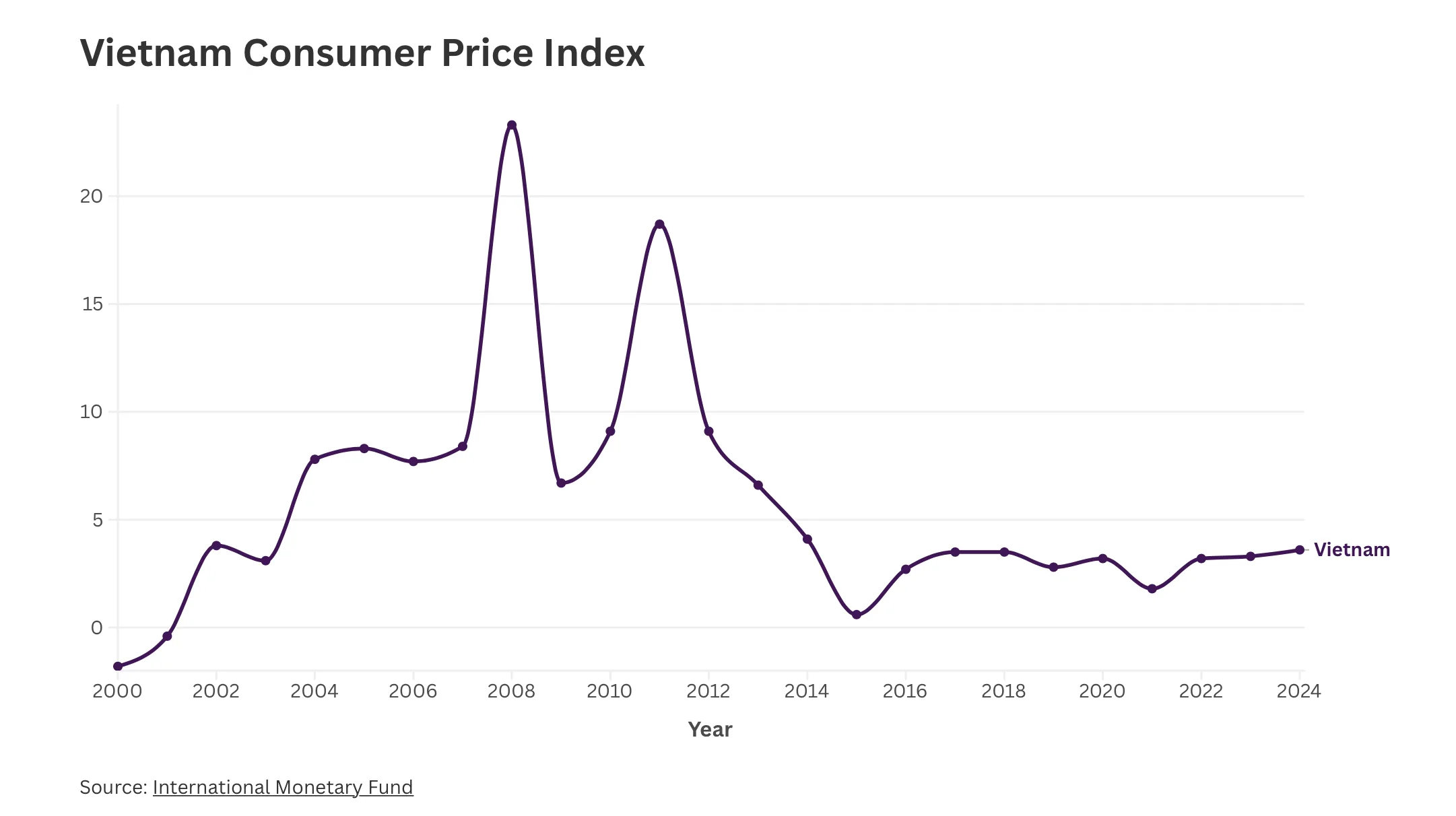

Inflation Remains Controlled Despite Uptick

Vietnam’s Consumer Price Index (CPI) rose by 3.22% year-on-year in the first quarter of 2025, according to the General Statistics Office (GSO). Core inflation, excluding volatile elements like food and energy, registered slightly lower at 3.01%. GSO officials attribute this increase to fluctuations in global commodity markets and ongoing geopolitical tensions that have disrupted supply chains and slowed global growth.

Major drivers of the CPI increase in the first half of 2025 include:

- Food and food services: This category saw a 3.78% rise, contributing over one-third to the overall CPI increase. Pork prices, in particular, jumped over 12% due to supply shortages and holiday demand, while rice and poultry prices also saw increases.

- Housing and utilities: Costs increased by 5.11%, driven by higher prices for construction materials like cement and steel, and an adjustment to retail electricity rates in late 2024.

- Healthcare costs: These experienced one of the sharpest rises, with pharmaceutical products and medical services increasing by 14.4%, pushing CPI higher by nearly 0.8 percentage points.

Conversely, some sectors experienced downward trends:

- Transport costs fell by 2.4% due to a nearly 10% drop in fuel prices and declining train fares.

- Education costs slightly decreased due to tuition fee waivers in certain provinces.

- Telecom prices also saw a marginal decline.

Core inflation remained below headline inflation, largely because it excludes the volatile food and energy components that were key price drivers during this period.

Image: vietnam-briefing

Strong Trade Performance Despite External Pressures

Vietnam’s trade performance in the first half of 2025 showcased a robust recovery, with import-export turnover reaching US$432 billion, a 16.1% increase from the same period last year. Exports grew by 14.4%, while imports rose by 17.9%, resulting in a trade surplus of US$7.63 billion.

Top export categories included:

- Computers, electronics, and parts: US$38.41 billion

- Telephones and components: US$22.4 billion

- Machinery, textile products, footwear, and wood-based goods also contributed significantly.

Leading imports mirrored export categories, with electronics and computer parts at US$56.19 billion, followed by machinery, textile fabrics, plastics, and metals.

The agriculture sector continued its pivotal role in trade, with agro-forestry-fisheries exports rising 15.5% year-on-year to nearly US33.84billion, generating a US9.83 billion trade surplus. Agricultural exports, valued at US$18.46 billion, grew by almost 185.16 billion and US$8.82 billion, respectively. Commodities such as coffee, pepper, and cashew nuts benefited from rising global prices, and rubber exports saw value gains despite lower shipment volumes. However, rice, fruit, and vegetable exports declined in value due to price drops and weaker demand in key markets.

Image: vietnam-briefing

FDI Surges, Signaling Investor Confidence

Foreign direct investment (FDI) into Vietnam reached an impressive US$21.51 billion in the first half of 2025, marking a 32.6% year-on-year increase, according to the Ministry of Finance. This strong performance was fueled by robust capital injections into existing projects and a sharp rise in capital contributions and share purchases.

While newly registered capital saw a 9.6% decline to US$9.3 billion, additional capital for ongoing projects surged by an astounding 122% to US$8.95 billion. Capital contributions and share purchases also rose significantly by 73.6%, totaling US$3.28 billion, indicating heightened investor interest in mergers, acquisitions, and strategic partnerships.

Disbursed FDI reached US$11.72 billion, up 8.1% year-on-year, representing the highest level recorded for a first-half period in five years. This reflects enhanced project implementation and improved operational efficiency across key sectors.

Vietnam continues to attract landmark investments, including:

- Sweden’s SYRE with a US$1 billion circular textiles hub.

- A US$1.5 billion project by the Trump Organization in Hung Yen.

- Major expansions such as the Yen So Park US$1.1 billion project and LEGO’s US$1.3 billion factory in Binh Duong, all underscoring strong investor confidence in Vietnam’s long-term potential as a manufacturing and innovation hub.

Navigating Global Economic Headwinds and Business Trends

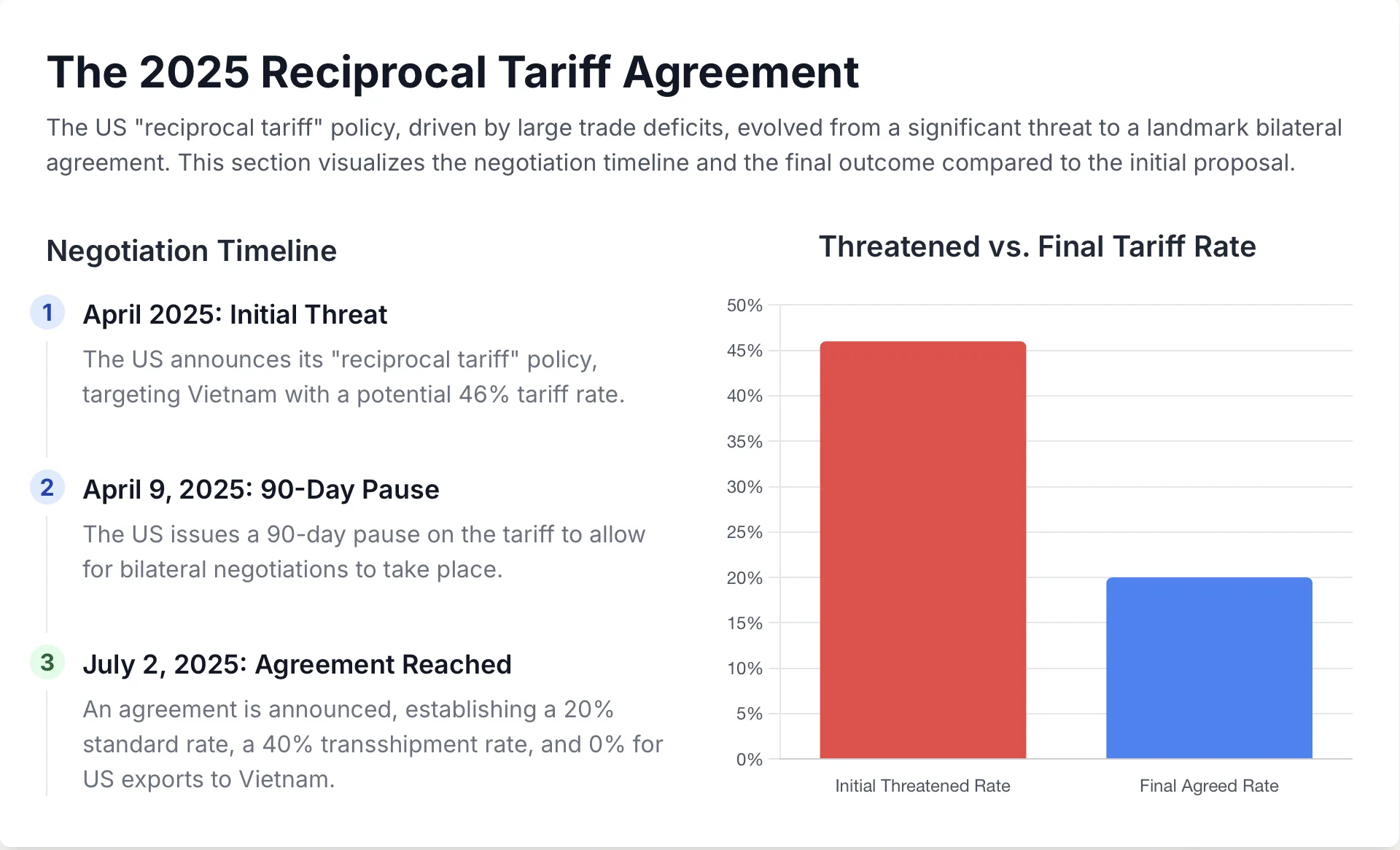

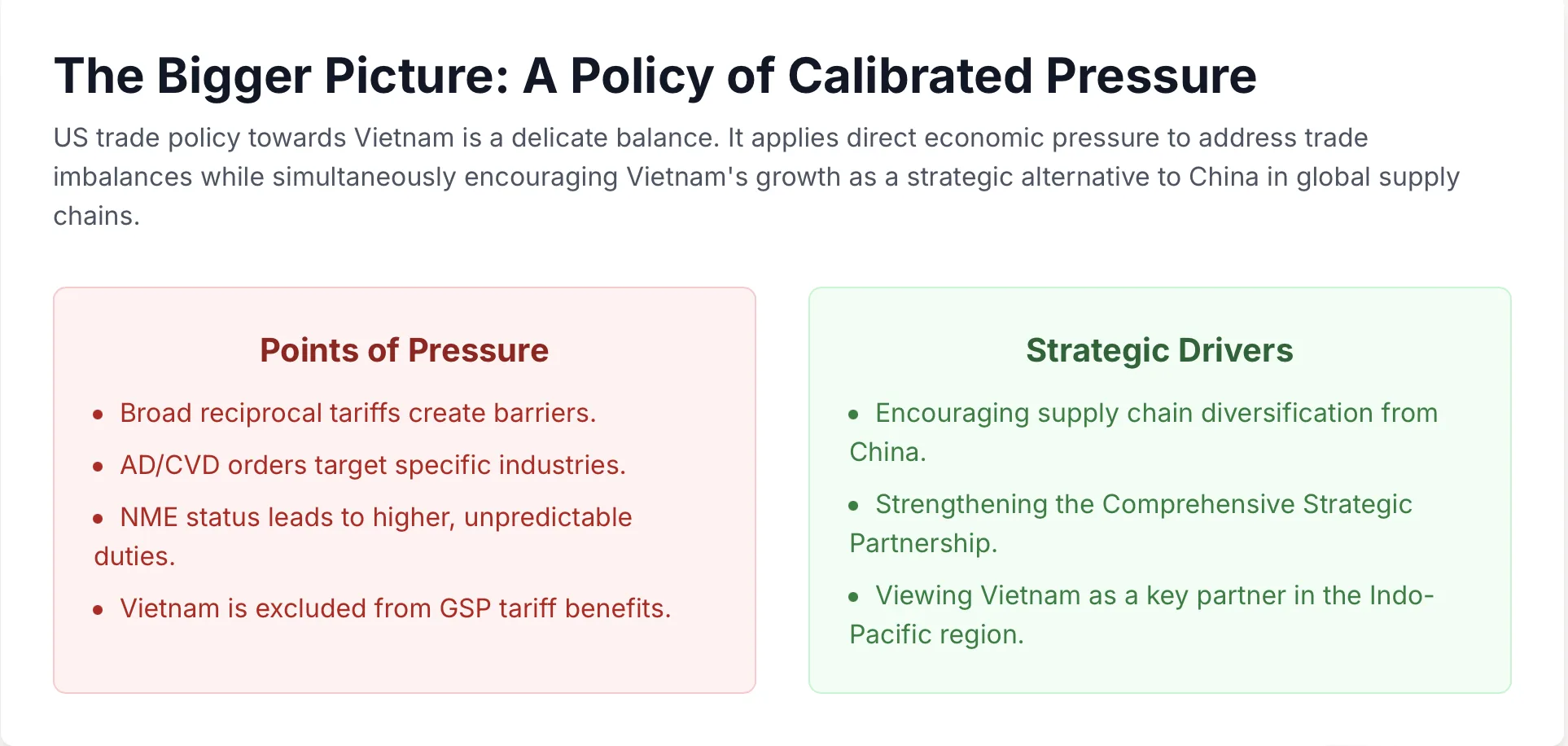

A newly signed trade agreement between Vietnam and the United States in July 2025 introduces both opportunities and complexities. While the deal provides Vietnam with preferential access to select U.S. markets, including large-engine vehicles and duty-free treatment for American imports, it also imposes new tariffs: a 20% duty on most Vietnamese goods and a 40% tariff on transshipped items from third countries.

Meanwhile, global demand has softened due to rising interest rates and geopolitical tensions, which was reflected in Vietnam’s April PMI falling to 45.6, indicating a contraction in manufacturing activity.

In the first half of 2025, Vietnam registered 91,200 newly established businesses, with a total capital of VND 820.9 trillion (approximately US$31.4 billion) and nearly 591,100 registered workers. This marks year-on-year growth of 11.8% in number, 9.9% in capital, and 13.9% in employment.

However, business exits also increased, with over 80,800 firms suspending operations, 34,000 halting business pending dissolution, and 12,300 fully dissolved, averaging 21,200 market exits monthly.

To counter this trend, the government is focusing on three strategic pillars: institutional reforms, infrastructure development, and workforce upskilling. Accelerated disbursement of public investment, particularly in national-scale projects like the Long Thanh International Airport and the North–South high-speed railway, is expected to stimulate economic activity and boost investor sentiment.

Outlook

The first half of 2025 saw Vietnam’s economic trajectory shaped by a complex interplay of external shocks and internal shifts. Rising trade tensions, especially with the US, and a turbulent global environment have put pressure on exports and industrial output. Despite these challenges, the country has managed to maintain steady GDP growth, moderate inflation, and a growing number of business registrations.

With global demand still fragile and geopolitical uncertainties lingering, Vietnam’s near-term focus will likely remain on boosting domestic consumption, fast-tracking public investment, and supporting enterprise resilience.

—

Understanding Vietnam’s Export Requirements

Understanding Vietnam’s Export Requirements

Growth Drivers

Growth Drivers

Challenges in Localization and Value Addition

Challenges in Localization and Value Addition

Global Impact and Responses

Global Impact and Responses Broader Trade Blocs Targeted

Broader Trade Blocs Targeted