Vietnam’s Export Outlook Mid-2025: Key Opportunities for Global Buyers

Vietnam is emerging as a resilient and competitive export powerhouse in mid2025. Amid global supply chain realignments and shifting trade strategies, the country’s export performance has accelerated, making it an increasingly attractive sourcing destination for international buyers.

Multinational companies like Apple, Nike, and Intel are actively shifting their production to Vietnam. For example, Apple aims to produce two-thirds of its AirPods in Vietnam by the end of 2025, while Nike already manufactures over half of its global footwear output there. These developments highlight Vietnam’s growing depth in manufacturing capabilities and the rising credibility of Vietnam suppliers in global value chains.

Vietnam’s Export Highlights (First Half 2025)

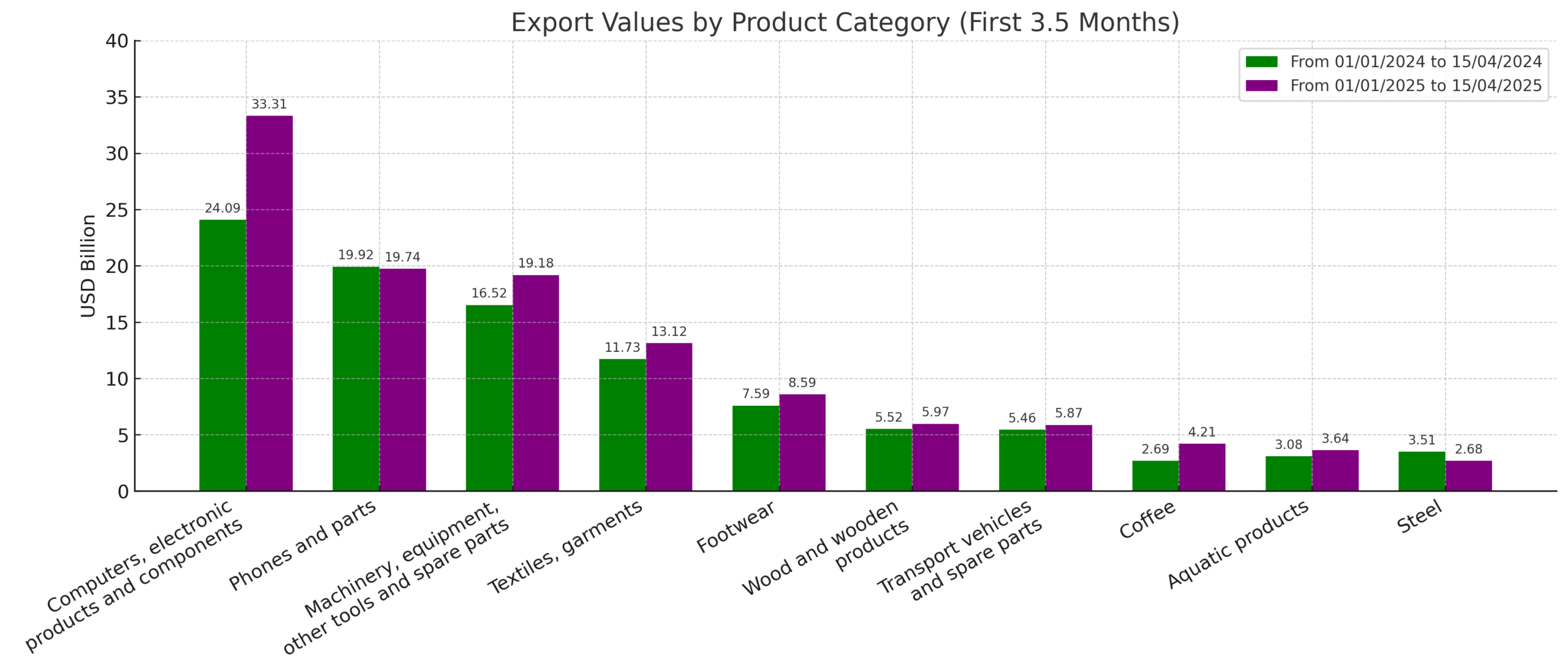

Vietnam’s export sector has seen remarkable growth in the first half of 2025 (H1 2025):

May 2025 alone recorded a 17% year-on-year (YoY) increase in exports, reaching $39.6 billion, with imports at $39 billion, nearly achieving a balanced trade account.

From January to May, total export turnover rose by approximately $22 billion compared to the same period in 2024—an impressive 14% YoY growth, bringing the total to nearly $180 billion.

This surge is supported by improved industrial output (+9.4% YoY), and a 51% increase in foreign direct investment (FDI), amounting to $18.4 billion, particularly in high-tech manufacturing zones.

Key Sectors Offering Opportunity

FMCG & Agri-Products

Vietnam’s fast-moving consumer goods (FMCG) segment is booming, driven by rising domestic consumption and growing demand from major export partners like the U.S. and China. In Q2 2025, Vietnam signed over $2 billion in U.S. agricultural and FMCG deals, enhancing opportunities for FMCG Vietnam wholesale suppliers. Key products include packaged foods, beverages, rice, coffee, and processed seafood.

Apparel & Textiles

Vietnam’s textile and garment exports rebounded in early 2025:

– The sector reached $15 billion in exports (January–May), up 12% YoY.

– Major markets include the U.S., EU, and Japan, though upcoming U.S. tariff reviews may pose short-term challenges.

This sector remains critical for Vietnam manufacturing, supported by a wide range of Vietnam clothing manufacturers and fabric suppliers.

Buyer Insights: What to Watch in H2 2025

1. Trade Politics & Tariff Decisions

The U.S. is currently reviewing trade policies that could impose up to 46% tariffs on Vietnamese goods, with decisions expected by July. These negotiations reflect broader geopolitical concerns, including alleged transshipment of Chinese products via Vietnam. Buyers should monitor updates closely to assess the impact on cost structures.

2. Infrastructure & Financial Reforms

Vietnam is investing in transforming Ho Chi Minh City and Da Nang into international financial centers, aimed at attracting foreign capital and streamlining forex operations. This move will improve financing options for exporters and help international buyers engage more efficiently with Vietnam suppliers.

- Global Demand & Market Diversification

While global demand growth may slow in some sectors, Vietnam’s aggressive expansion of free trade agreements (FTAs) — including the CPTPP, EVFTA, and RCEP — is helping unlock new markets across Latin America, the Middle East, and South Asia. These deals give buyers access to tariff reductions and diversified sourcing channels.

How to Tap Into Vietnam’s Export Market

To leverage Vietnam’s export growth, international buyers should:

– Align with FTA-compliant Vietnam suppliers to access tariff savings.

– Vet supply chains carefully to ensure local value-added content and avoid regulatory risks tied to transshipment.

– Engage early with FMCG Vietnam wholesale providers and contract manufacturers to secure pricing and capacity.

– Stay informed on trade negotiations, FTA expansions, and infrastructure reforms that affect sourcing conditions.

Vietnam is rapidly rising as a preferred sourcing destination for global buyers across electronics, apparel, and FMCG sectors. Its robust export growth, supportive trade agreements, and increasing manufacturing capacity signal long-term promise. Whether you’re exploring Vietnam manufacturing for high-volume production or partnering with agile Vietnam suppliers in consumer goods, 2025 presents a timely window of opportunity to deepen supply chain ties with this fast-evolving market.

For more information about the market: