The US-Vietnam Trade Landscape at a Glance

A complex relationship defined by strategic partnership and significant trade friction. Here are the key figures shaping the current policy environment.

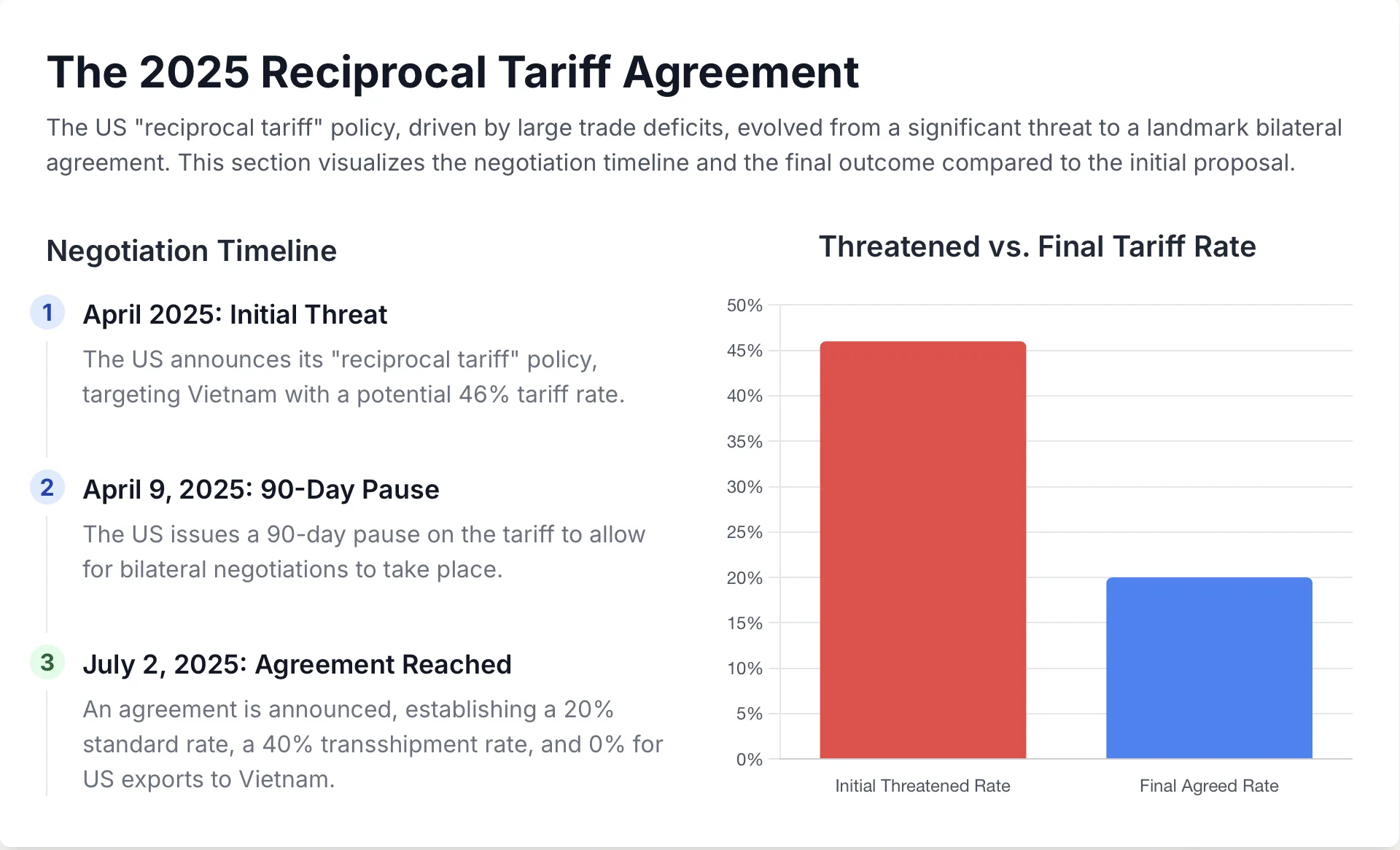

20%

Agreed Reciprocal Tariff

The new standard tariff on most Vietnamese exports to the US under the July 2025 agreement.

40%

Transshipment Tariff

A higher rate targeting goods from other countries (e.g., China) routed through Vietnam.

$122B

US Trade Deficit

The 2024 bilateral trade deficit that serves as a primary driver for US tariff policies.

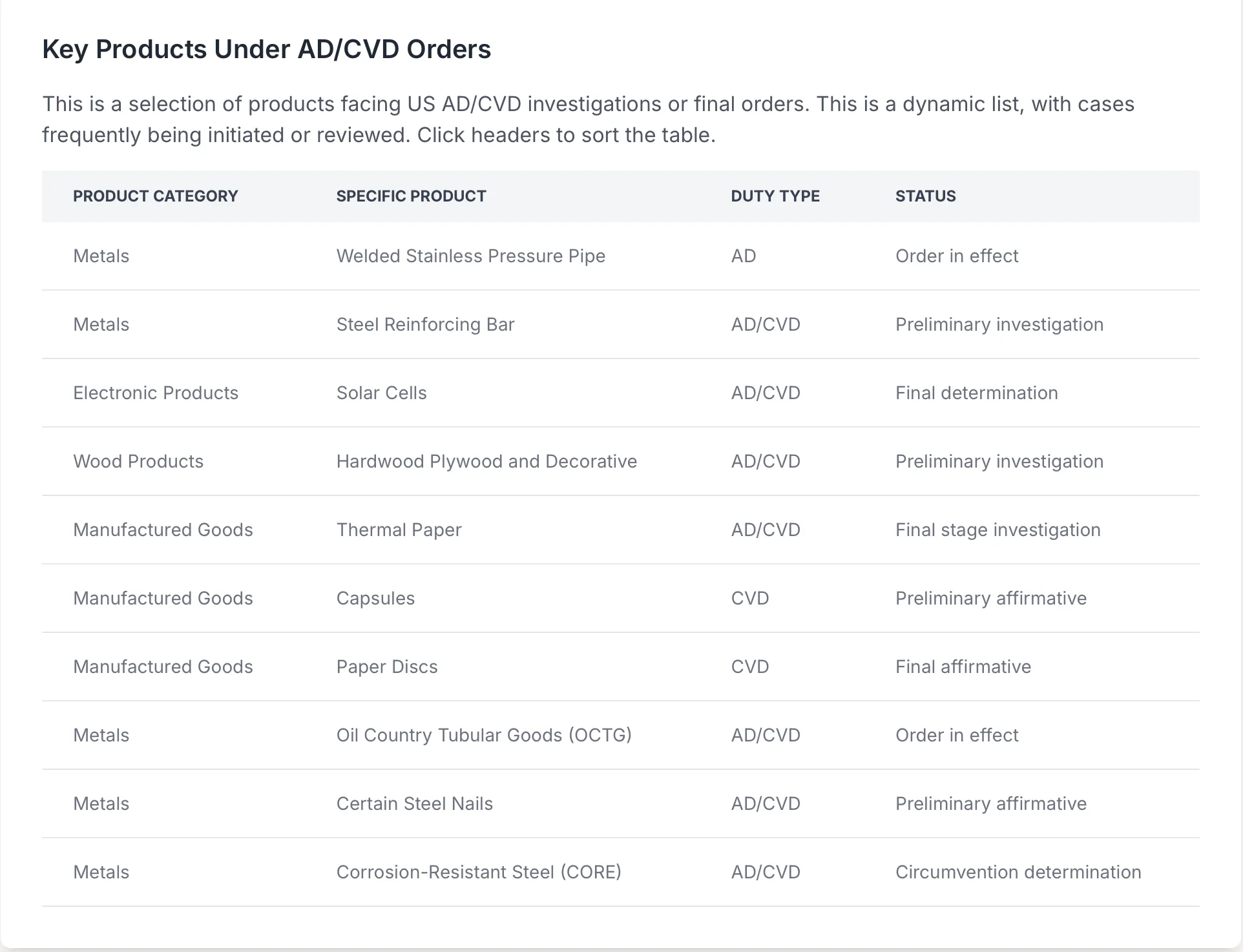

Anti-Dumping & Countervailing Duties (AD/CVD)

Separate from broad tariffs, AD/CVD orders target specific products deemed unfairly priced or subsidized. Vietnam’s designation as a Non-Market Economy (NME) is a critical factor that often results in higher, more unpredictable duties.

The Impact of Non-Market Economy (NME) Status

For Market Economies

The US uses the country’s own domestic prices and costs to calculate dumping margins.

For Non-Market Economies (like Vietnam)

The US disregards domestic data and uses prices from a “surrogate country,” which often leads to much higher duty rates.