If you look at the tag inside a high-end technical rucksack or a premium travel bag, there is a high probability it says “Made in Vietnam.” Vietnam has surpassed nearly every other nation to become the undisputed global leader in backpack manufacturing. From technical mountaineering packs to fashion-forward urban gear, the world’s most iconic brands have moved their production lines here for one reason: technical precision.

At PRIMO Sourcing, we help brands navigate this complex landscape. Whether you are a growing label or an established retailer, understanding why the giants choose a backpack manufacturer in Vietnam is the first step to optimizing your supply chain.

1. The “Hall of Fame”: Brands Manufacturing in Vietnam

The list of brands utilizing a bag factory in Vietnam reads like a “Who’s Who” of the outdoor and athletic industry. These companies prioritize Vietnam for its ability to handle complex, multi-component assemblies:

- Osprey: Renowned for the world’s best-fitting outdoor and hiking backpacks, utilizing specialized suspension systems.

- The North Face & Jansport: Staples for technical mountaineering gear and high-volume school and laptop backpacks.

- Under Armour & Nike: Leaders in the athletic and casual backpacks sector, focusing on performance materials and ergonomic design.

- Adidas: A major player in the sports and lifestyle backpacks market, blending street style with gym-ready functionality.

- Patagonia: Their commitment to ethical labor and durability is matched by Tier-1 factories in Vietnam meeting strict ESG standards.

2. Specialized Product Categories: Matching Gear to Expertise

Success in Vietnam depends on finding a factory with the specific machinery and skilled labor for your product type. At PRIMO Sourcing, we categorize production into specialized technical hubs:

⛰️ Outdoor and Hiking Backpacks

These are high-complexity items requiring 3D structural sewing and internal frame integration.

- Technical Focus: Load-bearing suspension, hydration port integration, and specialized bartacking at high-stress points to ensure trail durability.

🏃 Sports and Lifestyle Backpacks

The perfect blend of aesthetics and utility. Sports and lifestyle backpacks made in Vietnam often feature versatile designs that transition from the office to the gym.

- Technical Focus: Lightweight construction, stylish yet durable outer shells, and smart internal organization for daily essentials.

👟 Athletic and Casual Backpacks

Focused on performance and daily comfort. Athletic and casual backpacks require specialized compartments for gear.

- Technical Focus: Wet/dry separation pockets, ventilated shoe compartments, moisture-wicking back panels, and antimicrobial linings.

💻 School and Laptop Backpacks

The high-volume powerhouse. A reliable bag factory in Vietnam for this category must excel in protective padding and high-speed seasonal production.

- Technical Focus: High-density foam laptop sleeves, reinforced base panels, and the integration of anti-theft zippers.

🎖️ Tactical and Military Gear

Utilizing heavy-duty materials and modular systems.

- Technical Focus: Tensile strength testing, MOLLE webbing systems, and NIR (Near-Infrared) fabric compliance.

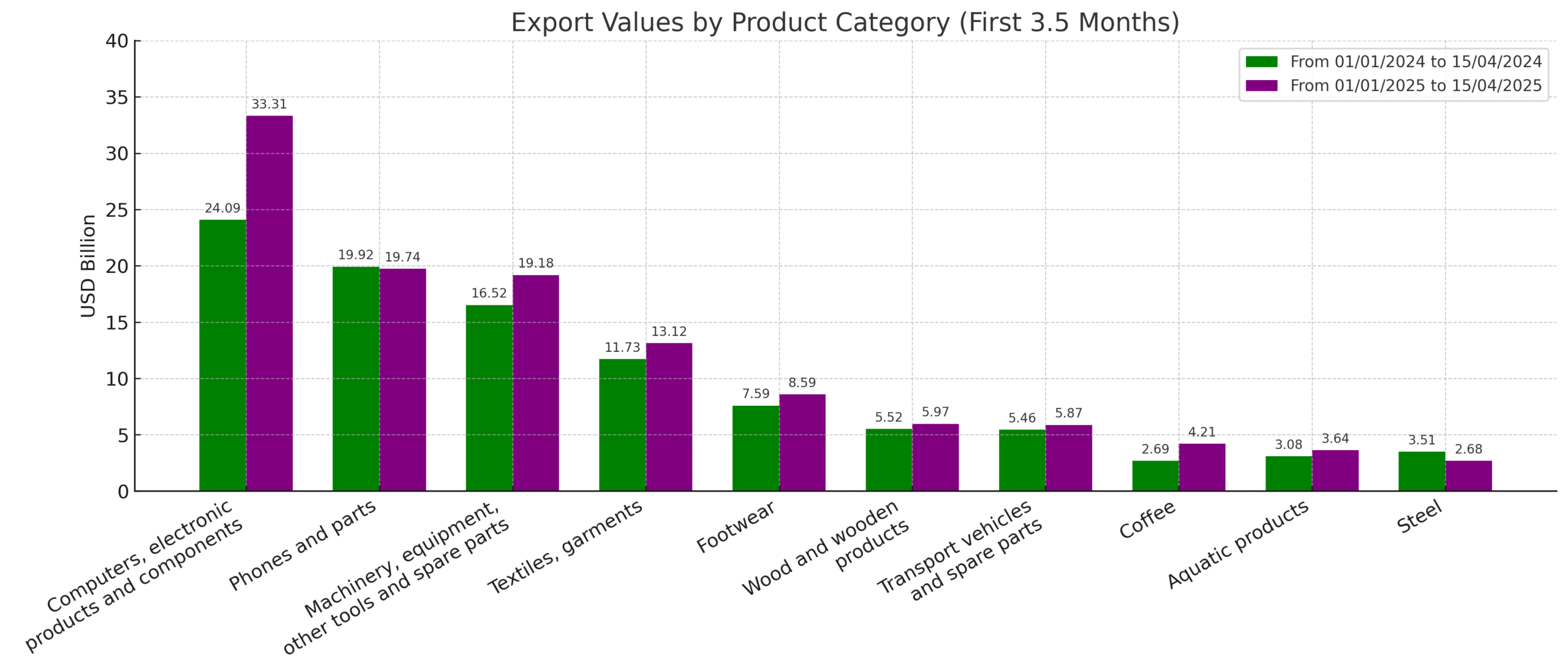

3. The Material Advantage: Cordura, YKK, and Duty-Free Trade

One reason a backpack manufacturer in Vietnam delivers superior quality is the immediate proximity to premium raw materials:

- Performance Fabrics: Easy access to Cordura®, Ballistic Nylon, and recycled rPET for sustainable collections.

- Hardware Leaders: Local production from YKK zippers and Duraflex buckles ensures your “Bill of Materials” consists of world-class components.

- Duty-Free Trade: Leveraging the EVFTA and CPTPP, brands exporting to Europe, Canada, and Australia often enjoy 0% import duties, providing a massive edge over China-based production.

4. The PRIMO Difference: Specialized QC & Transparency

Backpacks have more failure points than almost any other soft good. A single weak seam or a faulty zipper can ruin a brand’s reputation. PRIMO Sourcing provides:

- In-Line Quality Control: We inspect technical sewing and internal frame tension during the assembly process, not just at the end.

- Conflict-Free Representation: We charge a clear service fee. We work for you, not the factory, meaning we are incentivized to fail poor-quality batches before they ship.

- Material Verification: We verify that the Cordura or YKK components you pay for are exactly what the factory uses in production.

Ready to scale your brand with a world-class backpack manufacturer in Vietnam?

Partner with PRIMO Sourcing to access the technical expertise and transparency your brand deserves.

Contact PRIMO Sourcing today to find your ideal manufacturing partner.

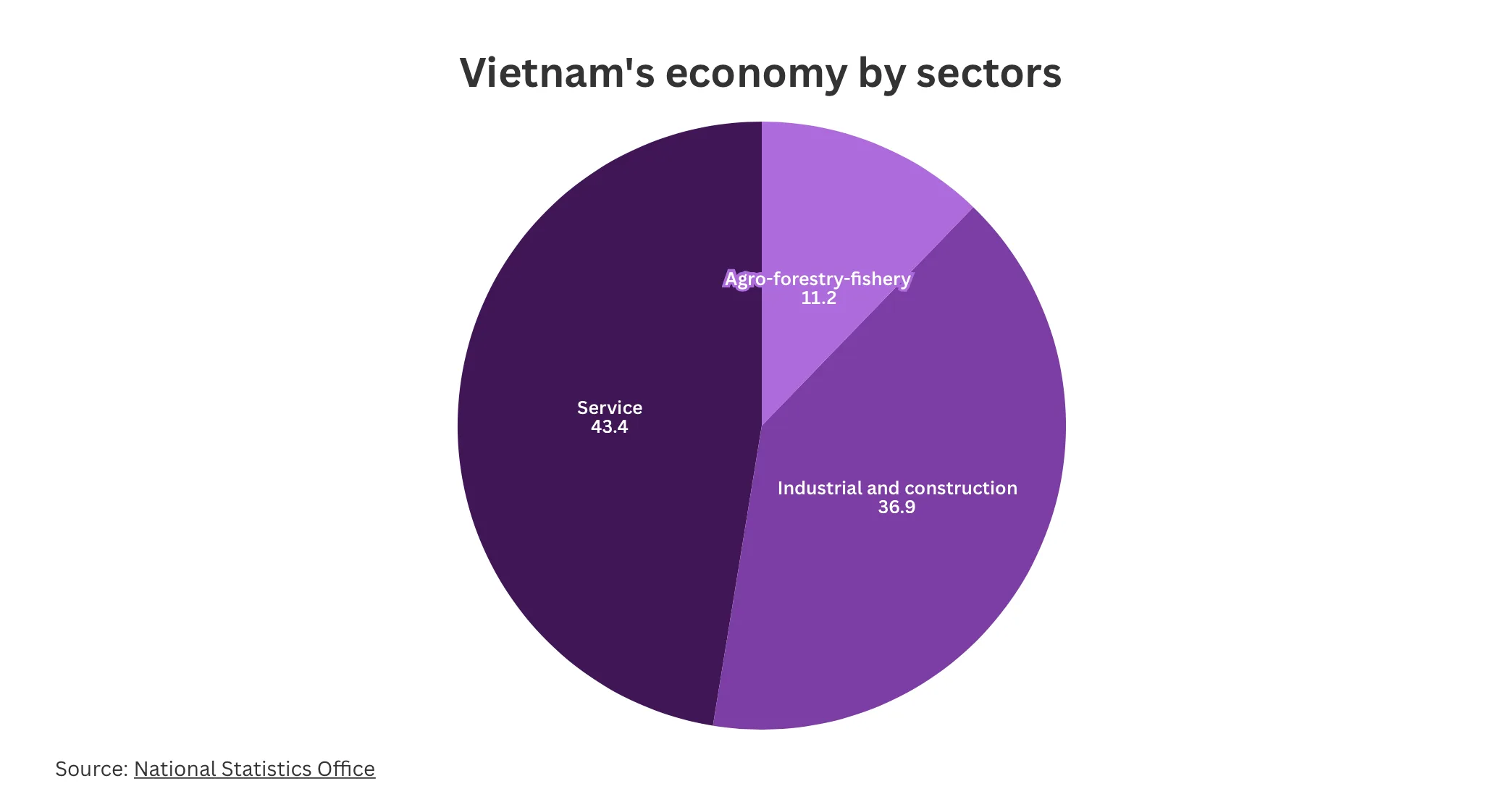

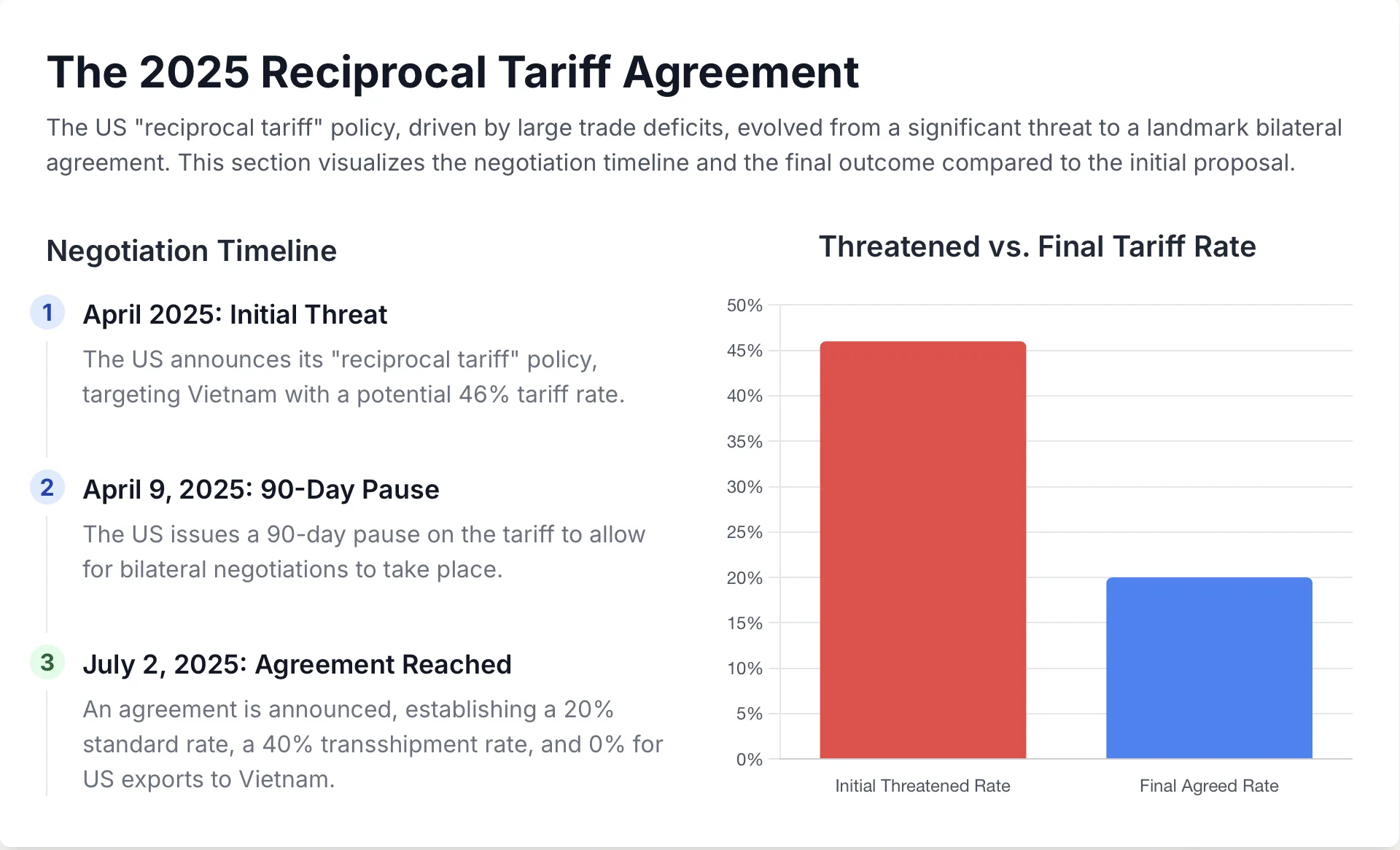

Global Impact and Responses

Global Impact and Responses Broader Trade Blocs Targeted

Broader Trade Blocs Targeted

Navigating the Challenges: How We Mitigate Risks for Your Business

Navigating the Challenges: How We Mitigate Risks for Your Business

Our Strategy for Cost-Effective Vietnam Sourcing

Our Strategy for Cost-Effective Vietnam Sourcing