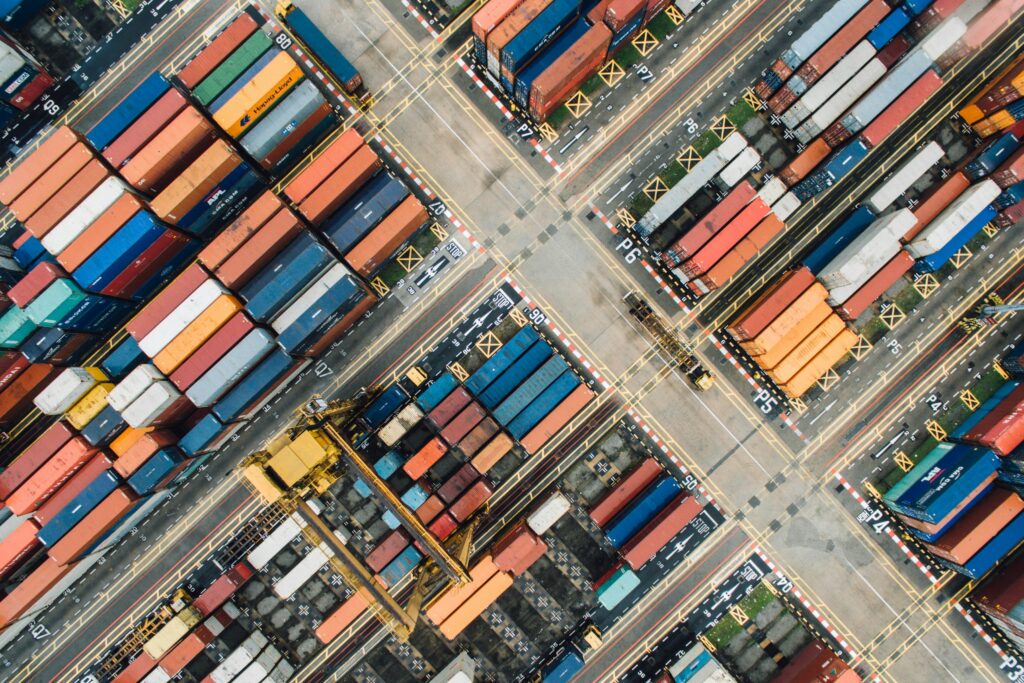

Importing goods from any country involves navigating a maze of regulations, and Vietnam is no exception. For foreign businesses, understanding and complying with Vietnam import regulations is critical to ensuring a smooth, timely, and cost-effective journey for your products. A single misstep can lead to significant delays, unexpected costs, or even goods being held up at customs. This is where expert assistance in customs clearance in Vietnam and understanding import duties in Vietnam becomes invaluable.

The Complexity of Vietnamese Import Laws

Vietnam’s trade policies are continuously evolving, influenced by both domestic economic goals and international trade agreements. While these agreements often offer benefits, they also introduce layers of complexity. Key aspects of Vietnam import regulations include:

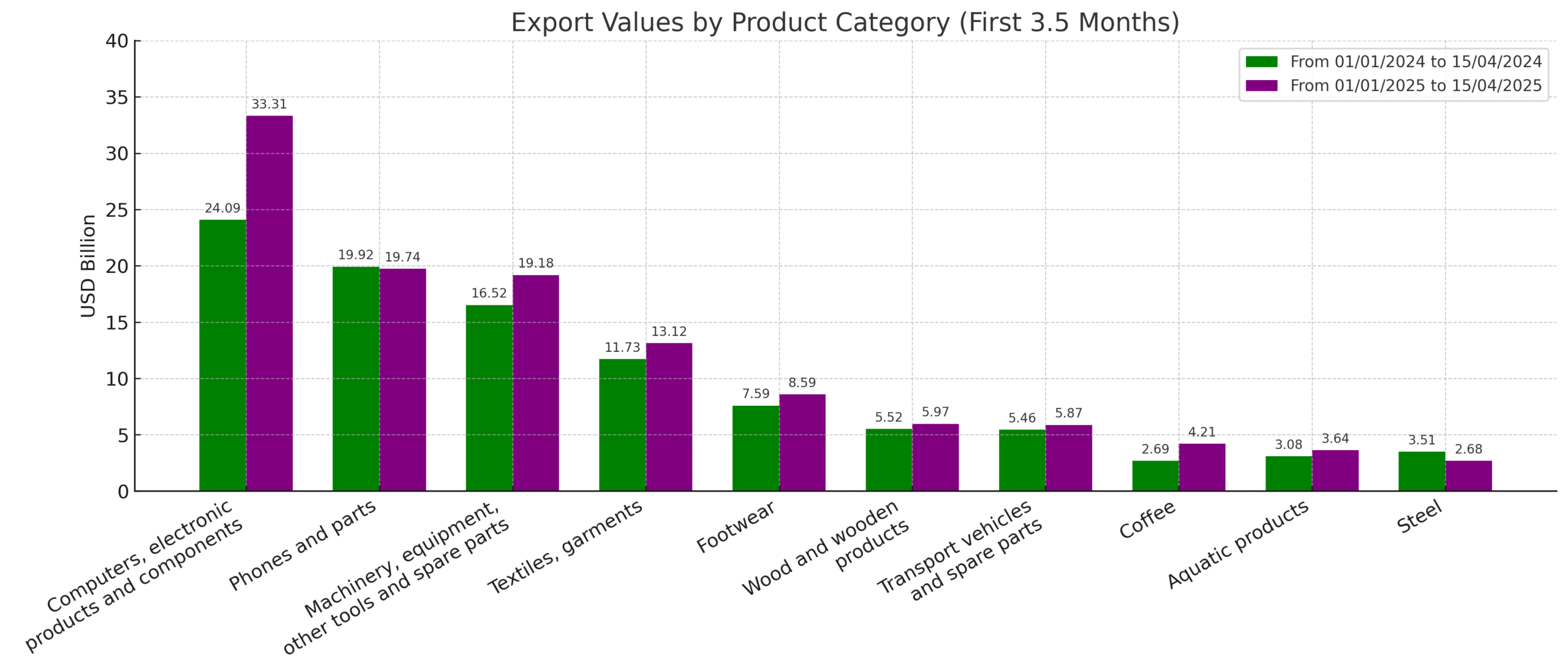

- Tariffs and Duties: Understanding the specific import duties in Vietnam that apply to your product category, which can vary widely based on product type, origin, and any applicable free trade agreements (FTAs).

- Required Documentation: A long list of documents, including commercial invoices, packing lists, bills of lading/airway bills, certificates of origin, quality certificates, and sometimes specific licenses or permits. Errors or omissions can cause immediate delays.

- Product-Specific Regulations: Certain goods (e.g., food, pharmaceuticals, cosmetics, electronics) are subject to additional layers of inspection, certification, and licensing by specialized government agencies.

- Valuation and Classification: Correctly classifying your goods under the Harmonized System (HS codes) is crucial for accurate duty calculation and compliance. Misclassification can lead to fines.

- Customs Procedures: The process of submitting declarations, undergoing inspections, and obtaining release of goods requires precise adherence to local protocols.

Navigating these complexities without local expertise can be a major hurdle for foreign importers, leading to frustrations and financial losses.

Our Expertise in Vietnam Import Regulations and Customs Clearance

Our company specializes in simplifying the import process for our international clients. We act as your knowledgeable guide and on-the-ground team, ensuring full compliance with Vietnam import regulations and facilitating seamless customs clearance in Vietnam. Our goal is to make your goods’ journey as smooth and efficient as possible.

Our comprehensive services include:

- Tariff and Duty Assessment: We help you accurately determine the applicable import duties in Vietnam for your products, leveraging our knowledge of HS codes and free trade agreements to minimize your costs legally.

- Document Preparation and Review: We meticulously prepare and review all necessary import documentation, ensuring accuracy and completeness to prevent customs hold-ups. We stay updated on the latest requirements for various product types.

- Customs Clearance Management: Our experienced team manages the entire customs clearance in Vietnamprocess. This includes submitting declarations, coordinating with customs officials, addressing any inquiries, and resolving potential issues promptly.

- Product-Specific Compliance: For goods requiring special permits or certifications, we guide you through the process of obtaining these, connecting you with the relevant authorities and ensuring all conditions are met.

- Logistics Coordination: Beyond customs, we integrate with your logistics plan to ensure timely transport from the port/airport to your final destination, including warehousing if needed.

- Consultation and Advisory: We provide ongoing advice on changes in Vietnam import regulations, helping you adapt your sourcing strategies to maintain compliance and efficiency.

Ensuring a Hassle-Free Import Experience

By partnering with us, you gain a significant advantage in navigating the complexities of importing from Vietnam. We mitigate the risks associated with non-compliance, reduce unexpected costs, and accelerate the delivery of your goods. You can focus on your core business, confident that your products are moving smoothly through Vietnamese borders.

Don’t let complex Vietnam import regulations become a barrier to your sourcing success. Leverage our expertise to ensure a smooth, compliant, and cost-effective import journey for your products. Contact us today to discuss your import needs and learn how we can simplify customs clearance in Vietnam for your business.

Navigating the Challenges: How We Mitigate Risks for Your Business

Navigating the Challenges: How We Mitigate Risks for Your Business

Our Expertise in Textile Sourcing in Vietnam

Our Expertise in Textile Sourcing in Vietnam

Our Strategy for Cost-Effective Vietnam Sourcing

Our Strategy for Cost-Effective Vietnam Sourcing